Secured Futures Blog

Navigating the Complexities of Estate Planning with a Special Needs Child

Planning for the future is a daunting task for any family, but when you have a child with special needs, the complexities of estate planning become even more pronounced. Families face numerous legal, financial, and emotional challenges when making decisions that will impact their child's long-term care and well-being. From preserving access to crucial public benefits to creating a Pooled Special Needs Trust, careful planning is essential. In this blog, we'll explore key considerations families must take into account when estate planning for a child with special needs, key steps to take for maintaining government eligibility, and how working with trust professionals like Secured Futures can provide peace of mind and safeguard their future.

Things to Know About Estate Planning for a Special Needs Child

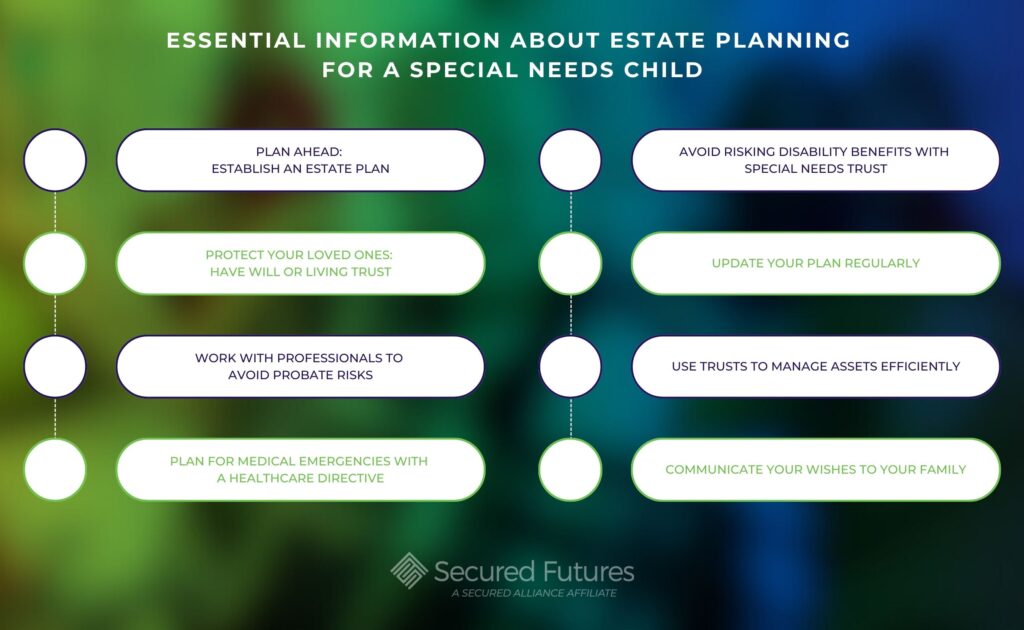

When planning for a child with special needs, here are essential factors that families, attorneys, and estate planners should keep in mind:

- Establish an Estate Plan Early

- Planning ahead ensures that your wishes are clearly outlined and can be carried out as intended. The earlier you establish an estate plan, the better prepared you will be to address changing circumstances and your child's evolving needs over time.

- Have a Will or Living Trust

- A will is necessary to dictate how your assets will be distributed, while a living trust can help manage assets during your lifetime and after passing. Including provisions specifically for your special needs child in either of these documents is critical to ensuring their future care and financial stability.

- Work with Professionals to Avoid Probate Risks

- Probate can be a lengthy and costly process. Professional guidance ensures that your assets are structured to bypass probate, allowing your child's inheritance to be accessed without unnecessary delays or legal expenses. Pooled Trusts, especially, can be used to avoid the probate process and expedite access to resources.

- Plan for Medical Emergencies with a Healthcare Directive

- A healthcare directive allows you to outline your medical wishes in the event of incapacitation. You can also designate a trusted person to make medical decisions for you, ensuring that your child's care continues seamlessly in case of a medical emergency.

- Avoid Risking Disability Benefits

- A direct inheritance can disqualify your child from receiving government benefits such as Supplemental Security Income (SSI) and Medicaid. Proper planning, such as using a Pooled Special Needs Trust, allows you to provide financial support while maintaining your child's eligibility for these crucial programs.

- Create a Special Needs Trust

- A Pooled Special Needs Trust is specifically designed to hold assets for a person with a disability. By establishing a Special Needs Trust, families can provide for their child's needs—such as medical care, education, or therapies—without jeopardizing access to government benefits. It's a key tool for safeguarding your child's financial future while preserving access to essential support programs.

- Update Your Plan Regularly

- Life changes such as marriage, divorce, the birth of another child, or changes in financial circumstances may require updates to your estate plan. Regular reviews and adjustments ensure that your plan remains relevant and continues to provide the intended benefits to your child.

- Use Trusts to Manage Assets Efficiently

- Different types of trusts, such as revocable living trusts, irrevocable trusts, and Special Needs Trusts, can be used to manage your estate in ways that align with your wishes. For families with special needs children, using a Special Needs Trust helps safeguard assets while providing tax benefits and maintaining eligibility for public assistance programs.

- Communicate Your Wishes to Your Family

- It's important to make sure your family and trusted advisors are aware of your estate plan, including the location of important documents, key individuals involved in decision-making, and any instructions specific to your child's care. Open communication reduces the chances of misunderstandings and ensures that everyone is on the same page.

Pooled Special Needs Trusts: Protecting Assets Without Compromising Benefits

Pooled Special Needs Trusts (SNTs) are the cornerstone of estate planning for families with children who have disabilities. These trusts ensure that your child can maintain access to essential government benefits while also providing for additional needs that public programs may not cover.

Without an SNT, any direct inheritance left to your child could disqualify them from receiving benefits like SSI or Medicaid. By placing cash & assets into a Pooled Special Needs Trust, families can fund the trust with savings, property, or life insurance policies, ensuring long-term financial support. A third-party trustee, such as Secured Futures, can then manage the trust, distributing funds for supplemental needs like specialized therapies, education, or recreational activities without jeopardizing eligibility for government programs.

How Secured Futures Can Help

At Secured Futures, we understand that no two families are alike, and each special needs plan must be tailored to fit the unique circumstances of your family. Our team of trust professionals works hand-in-hand with families, attorneys, and financial planners to create personalized estate plans that ensure the best outcomes for your loved one.

When you work with us, you gain access to dedicated professionals who specialize in the nuances of Special Needs and Trust Administration for benefits preservation. We simplify the complexities of estate planning by offering guidance, answering questions, and managing the trust for the lifetime of the beneficiary. Whether you're just starting the planning process or are ready to set up a trust, our goal is to provide you with peace of mind knowing that your child will be cared for.

Secure the Future Today

Navigating the intricacies of estate planning with a special needs child can feel overwhelming, but you don't have to go through it alone. Secured Futures is here to support families, attorneys, and estate planners through every step of the process. For personalized assistance or to learn more, contact us today.

Plan ahead. Protect your loved ones. Reach out to Secured Futures and start your estate planning journey today!

For more posts like this, follow Secured Futures everywhere you can find us online, and check out our Blog for articles that cover topics just like this one!

SUBSCRIBE TO LEARN MORE

Get news and updates straight to your inbox